The 2006 Survey of Women on Boards of California-Based Fortune 1000 Firms

The following is Part 1 of the early release of findings from

research on the leading female directors on California top corporations

-- a survey being conducted for the third year in a row by Champion

Boards.

- Champion Boards is a service of Santa Monica-based Technology Place Inc. -- designing

great boards of directors through knowledge and information.

- Elizabeth Ghaffari, project director, established Champion Boards as an advisory

service for female candidates for board roles, to help women

prepare themselves to pursue board opportunities . . . intelligently.

The Hype or The Reality?

Most of the popular media complain that corporate boards are

"at fault" for failing to place women on their boards of directors.

But the popular media fail to recognize how much blame should

be placed at the feet of state economic and legislative policies.

These factors contribute much more to the economic viability of

firms in a given market area. And when the firms do not succeed,

then there are fewer successful corporate boards on which women

can serve.

In the past year alone, a total of 17 firms went off the California Fortune 1000 list due to their relocation to other more economically-favorable states, or because they were bought out, merged with other firms located elsewhere, or went private or bankrupt. Fourteen of those firms had a total of 26 female directors, many of whom will not be absorbed into the acquiring company's board of directors. The others had zero women directors.

This is in addition to the total of 27 women who retired from boards of directors at California Fortune 1000 firms in 2003 and 2004. One other women passed away (Jane Evans, former director at KB Home).

Thus, in the past three years alone, California experienced the elimination of 54 board seats formerly held by female directors. With the exception of Evans, the losses were due to the changed economic circumstances in the corporations themselves, but also because of retirements or resignations by the women themselves. These factors would suggest that the women and companies alike faced difficult challenges as they considered expanded diversity on their boards of directors in 2006.

The Big Picture: The California Fortune 1000 Firms

We begin with a look at the mix of, or changes to, the California firms included in the Fortune 1000 list. We do this for the following reasons:

- the corporate economy is a dynamic marketplace

- large-scale changes may indicate underlying trends that could impact the state's share of women on boards

- loss of a large firm, such as Golden West Financial -- the only Fortune 500 board with a majority of female directors (5 women) -- will have a large impact on the state's tally

- increases in smaller firms will be a positive economic indicator overall, but would also suggest the state was adding smaller firms, smaller boards, and lower shares of women on boards -- at least for the short term

- the economic "big picture" includes retiring female directors -- a trend that occurs because of decisions by the women themselves, based on their age, tenure and personal career goals and objectives.

Thus, it is not merely corporate boardmembers who are making decisions about adding women to their boards. The share of women on boards also is a function of:

- the local economy, its maturity and lifestage

- the competitive marketplace

- trends in mergers and acquisitions

- presence of emerging growth firms as well as

- decision by the women themselves.

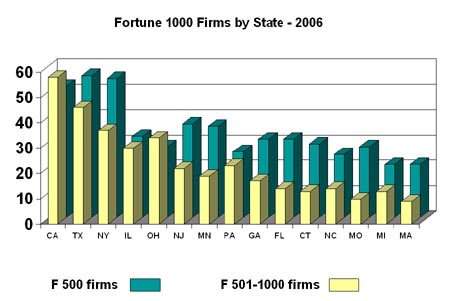

According to the April 17, 2006 issue of Fortune Magazine, California had

110 top Fortune 1000 firms, Texas had 102 and New York had 92.

Illinois and Ohio each had 62 top Fortune 1000 firms, New Jersey

had 59 and Minnesota had 55. Both New Jersey and Minnesota had

dramatic increases in their number of firms on the Fortune 1000

list (NJ added 23 firms while MN added 22 firms over the previous

year.)

California's dominance is due to a slight margin in the "bottom tier group" or the group rated #501 to #1000 among Fortune 1000 firms. In the April listing, California had 58 of the "bottom tier" companies compared to 46 located in Texas and 37 located in New York.

Among "top tier" Fortune 500 firms, Texas led with a total

of 56 firms; New York was second with 55 and California was third with 52 firms at that level.

There were 8 newcomers to the California Fortune 1000 list, adding a total of 8 new female directors. Three firms added zero female directors. The newcomer firms were all added to the "bottom tier":

| F1000 Rank |

Company |

City |

Female

Directors |

| #806 |

Spansion Inc. |

Sunnyvale |

1 |

| #863 |

Quicksilver |

Huntington Beach |

0 |

| #869 |

Indymac Bancorp |

Pasadena |

0 |

| #912 |

VeriSign |

Mountain View |

1 |

| #916 |

Molina Healthcare |

Long Beach |

2 |

| #929 |

Network Appliance |

Sunnyvale |

1 |

| #960 |

Autodesk |

San Rafael |

2 |

| #969 |

Lam Research |

Fremont |

1 |

The 9th addition to the list was Earle M. Jorgenson of Lynnwood, which was subsequently acquired by Reliance Steel & Aluminum.

The Exodus of Major California Firms

It was another bad year for California in that several firms moved out of the state, declared bankruptcy, or merged with other firms. This is a trend that the Los Angeles Economic Development Corporation (LAEDC) has been monitoring closely for the past 3 years, including direct communications with the Governor regarding a loss of almost 100 top corporations from the state.

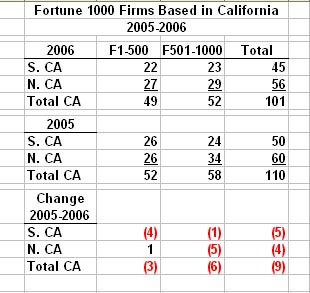

The net result for 2005-2006 is that California now has only 101 Fortune 1000 firms -- now one fewer than Texas. The changes are shown in the table below, Fortune 1000 Firms Based in California (2005 vs. 2006):

Company changes made prior to the April publication date include the following:

Fluor - relocated to Texas

UNOCAL - bought by Chevron

Providian Financial - bought by Washington Mutual

Titan - merged with L-3 Communications

Veritas Software - bought by Symantec

Dole Food - went private

Metro-Goldwyn-Mayer Inc. - went private

Westcorp - bought by Wachovia

Novellus Systems - fell off the Fortune list

The following corporate changes were made after the April 2006 publication date:

PacifiCare Health Systems - bought by United Health Group

Siebel Systems - bought by Oracle

Chiron - bought by Novartis

Knight-Ridder - bought by The McClatchy Company

Maxtor - bought by Seagate

William Lyon Homes - went private

Golden West Financial - bought by Wachovia

Calpine - went bankrupt

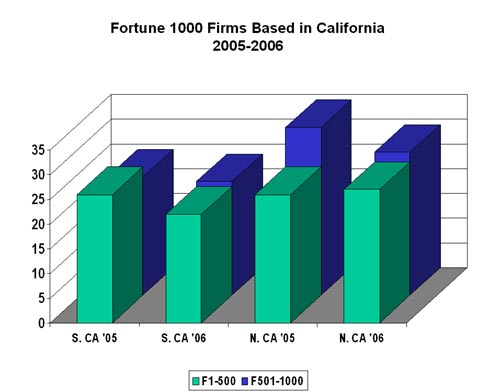

Northern California experienced the biggest drop off in firms, especially among the bottom tier firms, as shown in the graphic below,

According to the LAEDC, there are possibly another 3 top California firms that are evaluating putting themselves on the block or at least reducing their footprint in the California marketplace. If this trend continues, women on boards of directors will be less of an issue compared to the more fundamental challenge of how to keep major public corporations in our state.

For further information or to schedule a presentation about the

2006 Survey of Women on Boards of California-Based Fortune

1000 Firms, for your company/organization, contact:

Elizabeth Ghaffari

Champion Boards . . . a service of Technology Place Inc.

Tel: 310-396-9863

E-mail: eg@ChampionBoards.com

Web: www.ChampionBoards.com

|